Table of Contents

Nike Needs Breakthrough Innovation.. Fast

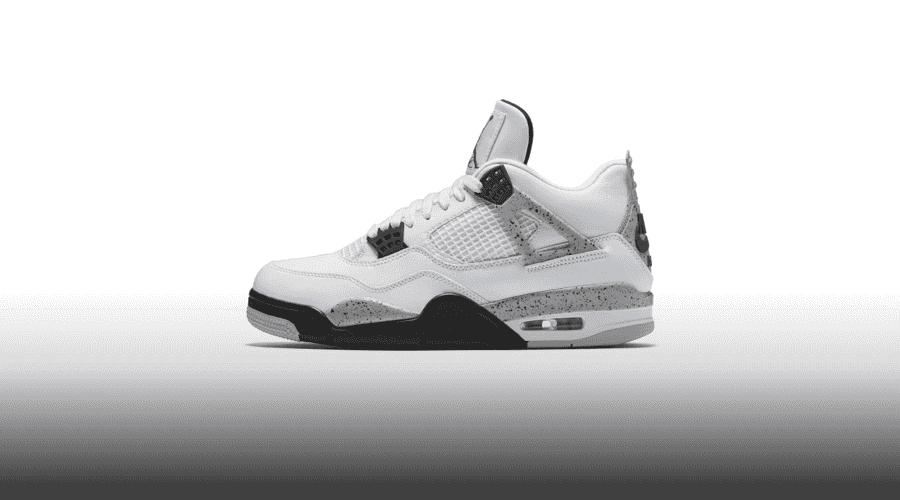

In a recent move aimed at emphasizing their dedication to product innovation, Nike announced a series of executive changes amidst growing concerns about the company's perceived stagnant product lineup. Despite the once-coveted Air Jordans and Air Maxes now sitting on shelves, some retro Jordans are even selling below retail prices in the secondary market.

Analyst Sam Poser from Williams Trading downgraded Nike's stock to sell, stating in a report that "Air Max is Becoming Air Min." This highlights the need for Nike to ramp up innovation, a sentiment echoed by other analysts. There is a consensus that the company lacks compelling new product offerings and that its current product range has become stale, particularly mentioning Air Max running shoes and family footwear as examples.

Nike's CEO, John Donahoe, acknowledged the need for change, stating that the company aims to streamline its focus on product, brand storytelling, and marketplace. He emphasized the importance of leveraging deep consumer insights to deliver breakthrough innovation and engagement while fostering long-term growth and profitability.

Industry analyst Chris Burns, founder of ARCH-USA, expressed a similar view, remarking that Nike is currently experiencing a decline in freshness and relevance, which he referred to as "peak Nike." Consumers who have been avid collectors of retro sneakers have now filled their closets, resulting in decreased demand for new releases.

Research reports indicate that searches for "Air Jordan" and "men's sneakers" on eBay have significantly declined. Premium Nike sneakers, including models such as the Pegasus, LeBron 9 low, Luka 1, Metcon, Space Hippie, Blazer, Air Force 1s, and Air Max 90s, 95s, and 270s, are being sold for less than $100. Some retro Jordans, such as the Jordan 5 Retro SE Craft Light Orewood Brown, have even sold for less than retail price on platforms like StockX.

This situation is reminiscent of Nike's past experiences, particularly in 2015 and 2016 when the company relied heavily on the Jordan brand to compensate for a lack of newness in other categories. At that time, Nike introduced the Air Max 270 and other next-generation products like Vaporfly, which helped regain consumer interest.

However, questions linger regarding Nike's current product-development capabilities. The loss of senior personnel with institutional knowledge, as well as a round of layoffs in 2020 that impacted the footwear division, may have affected the company's ability to innovate and deliver compelling products. Former Nike employees have suggested that the talent drain could manifest in store shelves, potentially affecting the spring and summer of 2023.

In conclusion, Nike faces challenges related to its product lineup, specifically with retro sneakers losing their appeal and a perceived lack of newness in other categories. Analysts and industry observers highlight the need for increased innovation to regain consumer interest and drive future growth. So what will Nike do next?